Introduction

If you’ve ever wondered how people fly in business or first class for almost nothing or stay in five-star hotels for “free”, the secret lies in points and miles. Leveraging credit card rewards programs and loyalty points can help you travel more often, more luxuriously, or even both. This guide will walk you through the key aspects of getting started with points and miles so you can maximize your travel rewards.

The most important rule using rewards credit cards is to make sure that you pay off all of your cards in full every month. If you are unable to pay your card off in full every month, the interest and fees you pay will greatly outweigh the rewards earned.

The terms points and miles are generally used interchangeably. Chase and American Express refer to theirs as points, while Capital One calls them miles.

Also, many will use the word free to describe travel booked with points. But even if you are not using cash, it is not truly free as many programs allow you to cash out your points for cash. There is inherent value to these points and miles. They are just a different form of currency and there is an opportunity cost to using them instead of cashing them out. Though, they are a tool to help greatly reduce the cost of travel.

While you can earn points by signing up for rewards programs and actually traveling (which I recommend you do), the best way is using credit cards on things you are already buying to accumulate points. Signing up for new credit cards will earn you the most as the sign up bonuses on cards far exceeds the earn potential of you every day spending categories.

Credit Card Myths and Credit Score

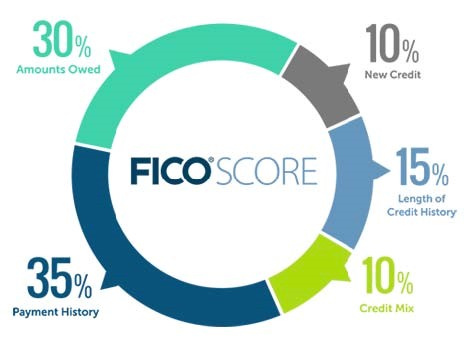

Many people believe that opening multiple credit cards will ruin their credit score. However, this is a myth. Your credit score is impacted more by factors such as payment history, credit utilization, and average account age. As long as you manage your cards responsibly—paying balances in full and on time—your score can actually improve with more available credit.

So if you use credit cards responsibly, they can be a great tool to help you improve or strengthen your credit score, while also earning a lot of points and miles to help you travel the world.

When applying for a new credit card, you will likely have your credit score drop by a few points, but in my experience, this recovers within just a few months. This is because you will have a negative mark for a new credit inquiry and for a new account. But you will also have positive marks for increased available credit and decreased credit utilization.

Also, if you cancel a card, your credit score may slightly decrease as well due to decrease in your total credit and change in average length of credit. But as you have more cards and more credit, canceling a card will have even less effect.

All of these things taken into consideration, even if you are applying for opening, and closing multiple cards per year, you will not have a long term negative effect on your credit score.

Always Use a Referral Link

Whenever you apply for a new credit card, always check if a referral link is available. These links often provide additional bonuses for both you and the referrer, sometimes exceeding the public offer. This is an easy way to get more points right from the start.

Please consider using my referral links as it greatly helps me out. But if not, use a family member, friend, or another creator’s link. Referrals benefit both parties, making it a win-win way to get started with points and miles.

Annual Fees

Many of the best travel rewards cards come with annual fees, sometimes high ones. However, these fees can often be justified with perks like travel credits, lounge access, free checked bags, and elite status. When considering a card, compare the benefits against the cost to determine if it makes sense for your travel habits.

Take the American Express Platinum Card for example as it has one of the highest annual fees at $695. But it includes a $200 airline fee credit, $200 hotel credit, $240 digital entertainment credit, $200 Uber credit, $100 Saks credit, $199 Clear credit, and some others. While I do not value all of these at full value if I have to go out of my way to use them, most are very easy to recoup the value. I still am easily able to offset the entire annual fee.

Another example is the Capital One Venture X Card which has an annual fee of $395. But there is an annual $300 credit towards travel in their travel portal. You also get 10,000 Capital One Venture Miles every card anniversary. These miles I value at a minimum of $100 (but likely more if used with transfer partners). This completely offsets the annual fee as long as you would spend $300 for travel in a year.

There are also many fee free cards that have good benefits and earning structures such as the Bilt Card, Capital One Savor One card, Amex Blue Business Plus card, etc.

So do not let annual fees scare you away. But do make sure to run the numbers and see that is makes sense for your purposes.

How to Earn Points

You can earn points through several methods:

- Credit Card Sign-Up Bonuses: These provide the largest boost to your points balance.

- Everyday Spending: Use cards that align with your spending categories (e.g., dining, travel, groceries).

- Shopping Portals: Many airlines and hotels have online shopping portals that offer bonus points for purchases.

- Dining Programs: Some loyalty programs award extra points when dining at partnered restaurants.

- Promotions: Airlines and hotels occasionally run promotions that accelerate earnings.

Check out my post on some of these shopping portals here.

Not All Points Are Created Equal

Different points have different values. For example, Chase Ultimate Rewards points are typically more valuable than Hilton Honors points. It’s essential to understand the relative worth of each program’s currency and focus on collecting the most valuable ones for your travel goals.

Generally IHG and Hilton points are worth about 0.5 cents per points and can frequently be bought for that much during points sales. Marriott are worth slightly more but still less than 1 cent per point. Hyatt points are the most valuable of the big hotels at around 1.5 – 2 cents per point.

Most airline programs are worth around 1.2 – 1.5 cents per points. And transferrable credit card points like Amex, Chase, Capital One, Citi, and Bilt are generally worth around 1.5 – 2 cents per point when transferred out to partners.

So if a point is worth 1.5 cents per point, 10,000 points equals $15.

I use these values as a guide and only redeem when I get the minimum value I’m okay with or better. And I use cash to book the other times when the points value isn’t there. And these numbers are just averages and you can get greatly outsized values compared to these. Like if you booked a $10,000 flight for 100,000 points, that’s a redemption value of 10 cents per point.

Credit Card Travel Portal Bookings

Many credit card issuers, such as Chase, Capital One, and American Express, offer their own travel portals where you can redeem points. While this can be convenient, you might not always get the best value. The vast majority of the time transferring points to airline or hotel partners provides a better redemption rate.

But this is a simple way, beginner friendly way to book, as you can use your points to book any flight or hotel that is cash bookable. But the down side to this it is typically a poorer value. And since you are using a third party booking platform and not direct, you would not earn points or have your status recognized for hotels. So I like to use this method when booking independent hotels, as I would not have these benefits anway.

If you have Chase points, the Chase portal is a great place to book through. It also offers better value than Capital One and American Express portals which are set at 1 cent per point (10,000 points equals $100). But if you have the Chase Sapphire Preferred, points in the portal are worth 1.25 cents per point (10,000 points equals $125). And if you have the Chase Sapphire Reserve, points in the portal are worth 1.5 cents per point (10,000 points equals $150).

Transfer Partners

The most powerful aspects of earning points with programs like Chase Ultimate Rewards, American Express Membership Rewards, Capital One Venture Miles, Citi ThankYou Points, and Bilt Rewards is the ability to transfer them to airline and hotel partners. This unlocks much higher redemption values compared to booking through a credit card’s travel portal.

But it’s important to know that once you transfer from a flexible credit card point to a transfer partner airline or hotel, you cannot transfer them back. It is a one way transfer only, so be sure your award is available before you transfer over.

Below is a list of the transfer partners of each of the credit card rewards programs:

American Express Membership Rewards

- Aer Lingus (Avios) – 1:1

- AeroMexico – 1:1.6

- Air Canada – 1:1

- Air France and KLM – 1:1

- ANA – 1:1 (exclusive to Amex)

- Avianca – 1:1

- British Airways (Avios) – 1:1

- Cathay Pacific – 1:1

- Delta Airlines – 1:1 (exclusive to Amex)

- Emirates – 1:1

- Etihad – 1:1

- Hawaiian – 1:1

- Iberia (Avios) – 1:1

- JetBlue – 5:4

- Qantas – 1:1

- Qatar (Avios) – 1:1

- Singapore Airlines – 1:1

- Virgin Atlantic – 1:1

- Choice Privileges – 1:1

- Hilton Honors – 1:2

- Marriott Bonvoy – 1:1

Chase Ultimate Rewards

- Aer Lingus (Avios) – 1:1

- Air Canada – 1:1

- Air France and KLM Flying Blue – 1:1

- Avianca – 1:1

- British Airways (Avios) – 1:1

- Emirates – 1:1

- Iberia (Avios) – 1:1

- JetBlue – 1:1

- Singapore Airlines – 1:1

- Southwest – 1:1

- United Airlines – 1:1 (only Chase and Bilt)

- Virgin Atlantic – 1:1

- IHG – 1:1

- Marriott Bonvoy – 1:1

- World of Hyatt – 1:1 (only Chase and Bilt)

Capital One Venture Miles

- AeroMexico – 1:1

- Air Canada – 1:1

- Air France and KLM Flying Blue – 1:1

- Avianca – 1:1

- British Airways (Avios) – 1:1

- Cathay Pacific – 1:1

- Emirates – 1:1

- Etihad – 1:1

- EVA Air – 4:3

- Finnair (Avios) – 1:1

- Qantas – 1:1

- Singapore Airlines – 1:1

- TAP Portugal – 1:1

- Turkish Airlines – 1:1

- Virgin Red (Atlantic Flying Club) – 1:1

- Accor Live Limitless – 2:1

- Choice Privileges – 1:1

- Wyndham – 1:1

Citi ThankYou Points

- AeroMexico – 1:1

- Air France and KLM Flying Blue – 1:1

- Avianca – 1:1

- Cathay Pacific – 1:1

- Emirates – 1:1

- Etihad – 1:1

- EVA Air – 1:1

- JetBlue – 1:1

- Qantas – 1:1

- Qatar (Avios) – 1:1

- Singapore Airlines – 1:1

- Thai Airways – 1:1

- Turkish Airlines – 1:1

- Virgin Atlantic – 1:1

- Accor Live Limitless – 2:1

- Choice Privileges – 1:2

- Leaders Club – 5:1

- Wyndham – 1:1

Bilt Rewards

- Air Canada – 1:1

- Air France and KLM Flying Blue – 1:1

- Alaska Airlines – 1:1 (exclusive to Bilt)

- British Airways (Avios) – 1:1

- Emirates – 1:1

- Hawaiian – 1:1

- United Airlines – 1:1 (only Chase and Bilt)

- IHG – 1:1

- Marriott Bonvoy – 1:1

- World of Hyatt – 1:1 (only Chase and Bilt)

You Don’t Have to Fly on the Airline You Use Miles To Book With

Many people assume that if you earn miles with an airline, you have to use them for flights on that airline. In reality, airlines are part of alliances or have partnerships that allow you to redeem miles on partner airlines. This expands your options for booking award flights.

Most people are familiar with using United MileagePlus Miles to book a United flight or using Delta SkyMiles to book a Delta flight. But you can also use United MileagePlus Miles to book flights on other airlines such as Lufthansa, Swiss, Singapore, and ANA. Or you could use American AAdvantage Miles to book flights on British Airways, Japan Airlines, and Qatar.

Most of these are partnerships are through the three major airline alliances; Star Alliance, SkyTeam, and One World. Each of the 3 major US airlines belongs to a different alliance. United is in Star Alliance, American is in Oneworld, and Delta is in SkyTeam. But some airlines also have other partnerships, like the ability to book ANA flights with Virgin Atlantic Miles even though they are in different alliances.

Star Alliance

- United Airlines

- Air Canada

- Lufthansa

- Swiss

- ANA

- Singapore Airlines

- Brussels Airlines

- Austrian Airlines

- Aegean Airlines

- Air China

- Air India

- Air New Zealand

- Asiana Airlines

- Avianca

- Copa Airlines

- Croatia Airlines

- Egyptair

- Ethiopian Airlines

- EVA Airways

- LOT Polish Airlines

- Shenzhen Airlines

- South African Airways

- TAP Air Portugal

- Thai Airways

- Turkish Airlines

Oneworld

- American Airlines

- Alaska Airlines

- British Airways

- Cathay Pacific

- Qantas

- Finnair

- Iberia

- Japan Airlines

- Malaysia Airlines

- Qatar Airways

- Royal Air Maroc

- Royal Jordanian

- SriLankan Airlines

SkyTeam

- Delta Air Lines

- Air France

- KLM

- Virgin Atlantic

- Aerolineas Argentinas

- Aeromexico

- Air Europa

- China Airlines

- China Eastern

- Garuda Indonesia

- Kenya Airways

- Korean Air

- Middle East Airlines

- SAS

- Saudia

- TAROM

- Vietnam Airlines

- XiamenAir

- Aeroflot (suspended)

Flexibility is Key

Unlike when you typically book flights or hotels with cash, you will not have the same ability to book any flight. The more flexible you can be, the better. That flexibility can be on when you fly, where you fly to, and where you fly from. If you have a specific date you need to fly and it has to be direct, then the chances of finding good award availability is slim, but not impossible. When you book a cash flight, if theres an open seat, it can be purchased. With award bookings with points, most airlines only release a limited number of seats to book this way, especially in the premium cabins like business and first class. There may be flights with 100 open seats, but none bookable with points. The same can be true with hotel rooms, but these are generally more available except the high demand properties.

The best availability to book international award tickets is either very far in advance about a year, or very close in, like a couple weeks out. Domestic tickets generally have more availability. But if you want to travel to some where specific in Europe, say London or Paris, the best flights may not be into these cities. But intra-Europe flights are generally cheap and short. So I will also look for flights into cities such as Amsterdam or Frankfurt that are a really good deal. Then you can book a separate cheap cash ticket for maybe $50 to the city you actually want to visit.

Booking One Way Tickets

You are most likely used to booking round trip flights. This is often the better deal as one way cash bookings can be upwards of 80% the cost of roundtrip bookings. This is not the case with award bookings on points. They are priced the same regardless. So you will book award flights as one way. This also provides greater flexibility to book different airlines or different routes in each direction and find a better deal.

Refundability

All of the major US airlines; United, Delta, American, Alaska, and Southwest offer complete refunds on points bookings essentially up until the doors close on the flight. So if you cancel, you will get the entire points and taxes refunded. International programs are a bit different. Some are fully refundable, some charge a fee like $50-100 or so to refund everything, and others are non-refundable (though these are rare). So make sure to check into the cancellation policy.

But the fully refundable programs, I book liberally if I find a good deal because I know I cancel and get everything refunded.

Points and Miles Expiration

Many programs have no expiration on your points and miles. But some programs due allow your points to expire after an amount of time without any activity. It is important to know these and not allow you hard earned points to disappear.

All of the major credit card transferable points like American Express Membership Rewards, Chase Ultimate Rewards, Capital One Venture Miles, Bilt Rewards, and Citi ThankYou Points never expire. All of the major hotel points like Hilton Honors, Marriott Bonvoy, IHG, and Hyatt never expire. Airlines are a bit different though. United MileagePlus Miles, Delta SkyMiles, Southwest Rapid Rewards, JetBlue TrueBlue, and Hawaiian Hawaiian Miles never expire. But others such as American AAdvantage Miles, Alaska Mileage Plan, Spirit Free Spirit Miles, Air Canada Aeroplan, Air France/KLM Flying Blue, ANA Mileage Club, Emirates Skywards, and others do expire after a set amount of time ranging from as little as 12 months to as much as 36 months. Most of these expirations can be extended by any activity to you account including transferring in miles, using miles to book an award ticket, or earning miles.

Maximize Travel Versus More Luxurious Travel

Some travelers prefer to stretch their points for as many trips as possible, while others use them for first-class flights and five-star hotels. Your strategy depends on your travel goals. If you are okay traveling in economy and just want a basic hotel, your points can go very far. I like to use my points for a combination of both.

Points and miles allow me to experience travel I would never otherwise be able to like flying in international first class of airlines such as ANA, Lufthansa, Singapore, Etihad, Emirates, etc… These flights can cost over $10,000 one way. But the ability to book using points after signing up for a single credit card and paying nominal fees, makes these experiences accessible.

How Not to Redeem Points

There are many ways credit card companies will allow you you use your points such as buying gift cards or using as a statement credit. I would avoid any redemption value of less that $0.01 per point. Do not use your American Express points for your Amazon purchases for only $0.006 each.

- Gift Cards: Often a poor value compared to travel redemptions.

- Merchandise: The redemption rates are usually worse than flights or hotel stays.

- Cash Back: While flexible, this typically yields lower value compared to transferring points to travel partners.

How to Find Flights

I would start with Google Flights. It gives you a good idea of the flights available. And the cash price might be good enough you don’t need to use books. Also an extension like Points Path that will compare the cash price to the current points price.

If you have points in a particular airline you want to use, you can start with their direct website.

But I would recommend to start with a website that search multiple programs at once. There are many award search aggregator tools such as point.me, PointsYeah, and Seats.aero. In general I believe point.me and PointsYeah are a bit more beginner friendly. I always start with seats.aero myself though. It does require a bit more knowledge of airport codes and having an idea of who transfers to who, but I think it is a more powerful tool. All of these have both free versions that are limited in different ways and a paid premium version that unlocks more features. I have the premium version of seats.aero which allows searches up to one year out and more search parameters.

One of the best features of a search tool like these is to set alerts. So if you are looking for a particular flight on a certain day, but it’s not currently available, you can set an alert. Then if that flight becomes available, they will let you know. I will also use this to book a flight that is not my preferred, but one I’m comfortable taking and is refundable. Then I will set an alert and if a better flight becomes available, I will book it and cancel the refundable booking.

How to Find Hotels

Most of the time hotel award bookings are more available and less nuanced than flights. I usually just search the individual programs, but there are some tools like Rooms.aero to help you find hard to book destinations. You can also set up alerts for these.

The best tool I have found to aggregate points bookings and compare them to cash prices is Daily Drop Pro. Search a city and dates and it will show you all of the hotels bookable with points across all the programs as well as show you the cash price. It will even recommend whether to use cash or points depending on the rates.

Always Sign Up for Rewards Programs

Even if you’re not ready to use points and miles, always sign up for airline and hotel loyalty programs. This ensures that you accumulate points on paid stays and flights, and it can sometimes lead to targeted offers.

Some programs (very few) will also not allow you to transfer points in if your account is brand new. Some like your account to be a month or two old. So if you think you might use a program, go ahead and sign up for an account because it’s free and quick.

Best Cards to Get Started With

If you’re new to points and miles, consider beginner-friendly cards such as:

- Chase Sapphire Preferred: My number one recommended travel card to start with. Great for flexible travel redemptions and strong transfer partners.

- Capital One Venture X: Simple 2x miles earnings on all purchases. $395 annual fee that is easily offset with a $300 travel credit and 10,000 miles every card anniversary. This card is the cheapest and easiest way to get airport lounge access. And Capital One Lounges are some of the best.

Cards to Spend on Versus Cards to Hold for the Perks

Some cards are best for ongoing spending due to high earning rates, while others are worth holding for the perks alone:

- Spend On: Cards with strong category bonuses like the Amex Gold (dining/groceries), Chase Sapphire Preferred (travel/dining), or the Capital One Venture X (2x on everything)

- Hold for Perks (sock drawer cards): These cards mostly include hotel and airline cards. Most hotel and airline cards I would not recommend putting everyday spend on. I would only use them for spend on that particular hotel or airline. But they may be worth holding onto for the perks. Most hotel cards with annual fees around $100 include a free night every year that usally is worth more than the annual fee. They may also give you status you otherwise wouldn’t be able to earn naturally through stays.

Example Flight and Hotel Bookings

The following are some flight and hotel booking that I have made either for myself or for friends/family:

Flights:

- Lufthansa First Class on a Boeing 747 ARN-FRA-ORD (Stockholm to Frankfurt to Chicago)

- 100k points + $92 in fees

- Booked through Air Canada with 100k points transferred from Amex

- Cash value $8,000-$10,000

- Lufthansa First Class on a Boeing 747 BOS-FRA-LHR (Boston to Frankfurt to London)

- 100k points + $92 in fees

- Booked through Air Canada with 100k points transferred from Capital One

- Cash value $8,000-$10,000

- Air France Business Class EWR-CDG and CDG-EWR (Newark to Paris and back)

- 55k points + ~$250 in fees each way

- Booked through Air France with 55k points transferred from Capital One

- SIngapore Airlines Suites on an A380 SIN-LHR (Singapore to London)

- 225k points + $46 in fees

- Booked through Singapore Airlines with 225k points transferred from Amex

- Cash value ~$8,000-$10,000

- Swiss Business Class ARN-ZRH-ORD-TYS (Stockholm to Zurich to Chicago to Knoxville)

- 80k points + $89 in fees

- Booked through United Airlines

- Cash value ~$4,500

Hotels:

- Graduate by Hilton State College for the Penn State v Ohio State game 11/1 – 11/3

- 70k Hilton Honors points per night for a total of 140k points

- Points purchased for 0.5 cents each (during a 100% bonus on points which happens frequently) costing $350 per night for a total of $700

- Normal price of this hotel is around $100-$200 per night, but during the game weekend it was a little over $1,600 per night with the total $3,251.65.

- All hotels in town were extremely elevated pricing as well secondary to the football game.

- Umbral Curio Collection México City during F1 Mexico Grand Prix 10/24/24 – 10/29/24

- 50k Hilton Honors points per night, but a total of 200k points for 5 nights since Hilton offers the 5th night free on award bookings

- I had Hilton points already available but others in the party bought points for 0.5 cent per point, for a cost of $200 per night, $1,000 total for 5 nights

- Normal price of this hotel is around $100-$200 per night, but during F1 was very elevated with the same 5 nights costing around $800 per night, $4,000 total for 5 nights.

- All hotels in town were extremely elevated pricing as well secondary to the F1 race.

- Calala Island in Nicaragua – SLH (Small Luxury Hotels of the World) property

- Booked with 3 Hilton free night certificates (150k points per night)

- Cash price of $4,165 per night for a total of $12,495 for 3 nights

- Park Hyatt Paris Vendome

- Booked for 40k Hyatt points per night

- Cash value ~$1,600 per night

Conclusion

Getting started with points and miles may seem overwhelming, but with the right approach, it can unlock incredible travel experiences. By strategically earning and redeeming points, taking advantage of transfer partners, and understanding program nuances, you can maximize your travel rewards and explore the world for less and more luxuriously . Happy travels!